- Quickbooks desktop payroll change fee account how to#

- Quickbooks desktop payroll change fee account upgrade#

- Quickbooks desktop payroll change fee account software#

Quickbooks desktop payroll change fee account software#

QuickBooks is the most extensively used small business accounting software for tracking financial health and managing income and expenses. What You Should Know About the QuickBooks Software If you’re on the fence about QuickBooks, let’s learn more about the software in this post. Intuit will not support a QuickBooks file issue if the version has been sunset. You’ll also want to keep this in mind for support. So if you do use payroll or any other service, it will require you to stay up to date. However, do keep in mind that Intuit sunsets versions every 3 year as they introduce a new QuickBooks Desktop year. If you don’t use any add-on services like payroll or bank feeds, you can usually use your non-subscription QuickBooks version for a few years to maximize your return on investment. There will be no additional subscription fees while using the software for your business needs. Unlike buying a subscription from Intuit directly, a reseller can sell you the QuickBooks Desktop application as a one-time fee. They can provide a complete business solution based on your needs, wants, and organizational goals. A reseller who participates in the QuickBooks Solution Provider program can not only sell Intuit products directly to clients but they are also QuickBooks ecosystem experts. Intuit actually has authorized resellers through their QuickBooks Solution Provider program. However, many are unaware that you can purchase QuickBooks Desktop as a standalone application without having to pay a subscription fee.

Quickbooks desktop payroll change fee account upgrade#

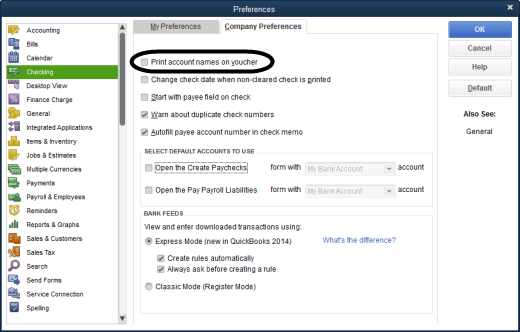

If you’re in the market to upgrade your QuickBooks Desktop application or maybe even waiting to purchase QuickBooks 2022, it may seem like you can only purchase a subscription plan. To save your preferences, select Continue, then Done.From software to even coffee, it seems like in today’s world everything is moving towards subscription based billing.Add a class for each employee, or assign one for all of them.Then choose how you want to track classes. In the Class Tracking section, select Edit ✎ to turn it on.In the Accounting section, select Edit ✎.Go to Settings ⚙ and select Payroll Settings.Turn on class tracking for Online Payroll

Quickbooks desktop payroll change fee account how to#

How to turn on classes in QuickBooks Online? This will open the New Payment Method window. Click the Payment Method drop down list, then select “”. Another window will open, allowing you to enter data for the new item.

In the Item List window, click the drop down arrow in the Item menu, then click New. In QuickBooks, go to Lists > Item List to open the Item List window. How to add and edit payment methods in QuickBooks? Put a check-mark on the Is subclass box.If you want a reminder when you haven't assigned a class, select the Prompt to assign classes checkbox.Select the Use class tracking for transactions checkbox.Select Accounting, then go to the Company Preferences tab.>.Go to the Edit menu, then select Preferences.› Advanced Distributed Learning Initiativeįrequently Asked Questions How to setup and use classes in QuickBooks?.› Laser Safety Officer Training Arizona.› Dairy Farm Management Training Program.› When Was The Tucson Sidewinders Spring Training Built.› When Do The Dodgers Play The Angels In Spring Training.

0 kommentar(er)

0 kommentar(er)